2022 tax brackets

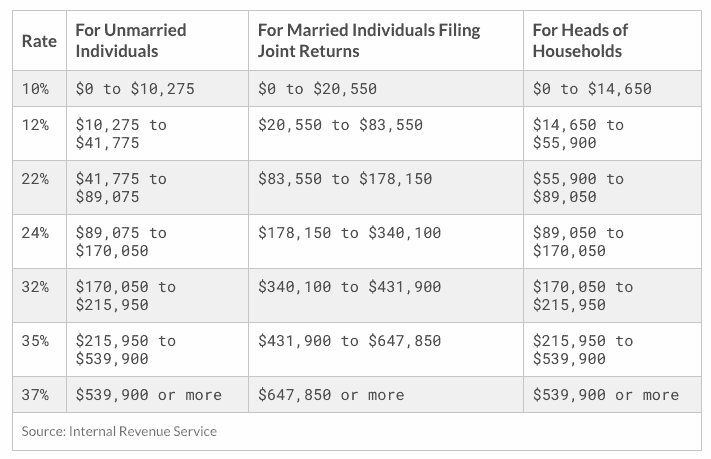

There are seven federal income tax rates in 2023. Taxable income up to 10275.

Nyc Property Tax Rates For 2022 23 Rosenberg Estis P C

Resident tax rates 202223 The above rates do not include the Medicare levy of 2.

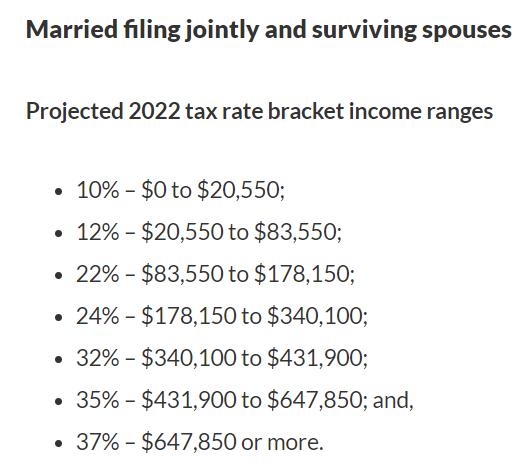

. This was further modified by Budget 2020 announcements to lift the 19 rate ceiling from 37000 to 45000 and the 325 tax bracket ceiling from 90000 to 120000. Whether you are single a head of household married. The IRS adjusts tax brackets annually using an adjusted version of the US governments Consumer Price Index.

Tax brackets 202223 Class 1 employed rates For employees For employers Please note. This device is too small. Heres how much individuals will pay in taxes according to their incomes.

If you can find 10000 in new deductions you pocket 2400. Entitlement to contribution-based benefits for employees retained for earnings. There are seven federal tax brackets for the 2021 tax year.

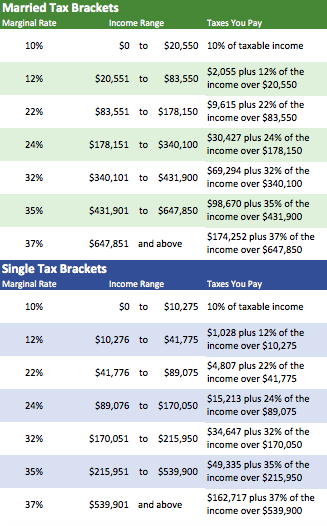

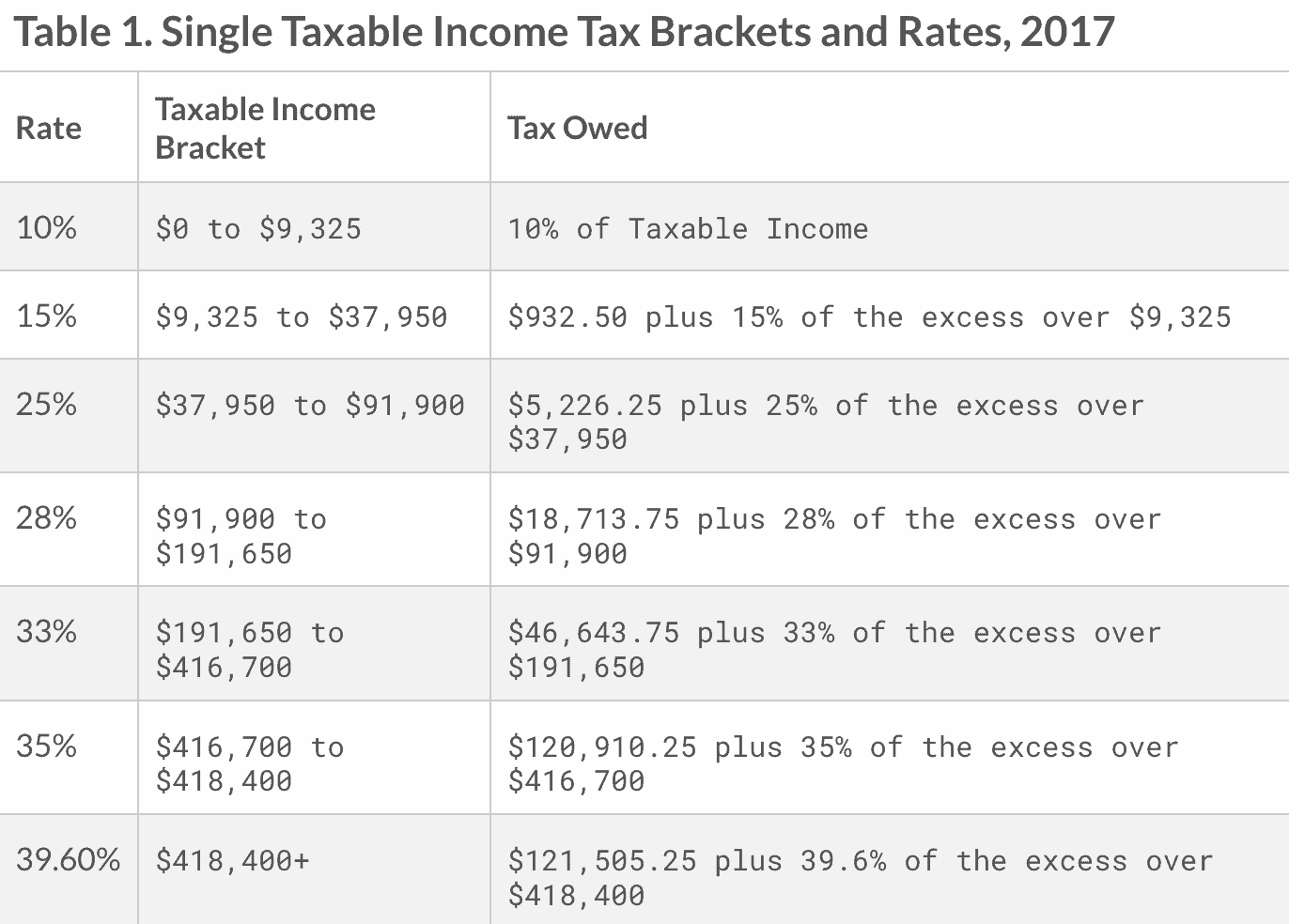

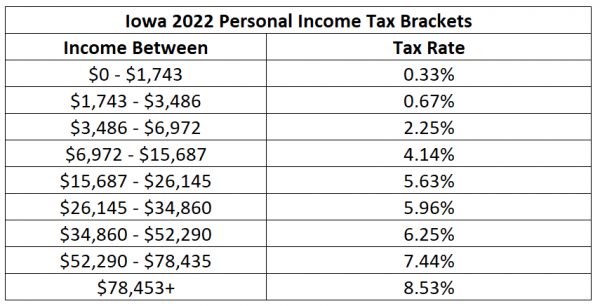

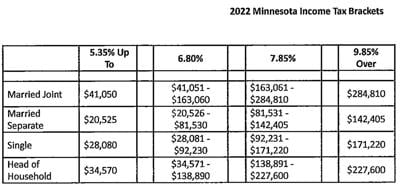

Resident tax rates 202122 The above rates do not include the Medicare levy of 2. The taxable income rate for single filers earning up to 10275 is 10 percent and for joint married filers is 10 percent tax on income up. The seven brackets remain the same 10 12 22 24 32 35 and 37 which were set after the 2017 Tax Cuts and Jobs Act.

10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. 10 12 22 24 32 35 and 37. Tax brackets for long-term capital gains investments held for more than one year are 15 and 20.

Individuals will be able to transfer up to 1292 million tax-free to their descendants up from just over 12 million in 2022. You and your spouse have taxable income of 210000. Each of the tax brackets income ranges jumped about 7 from last years numbers.

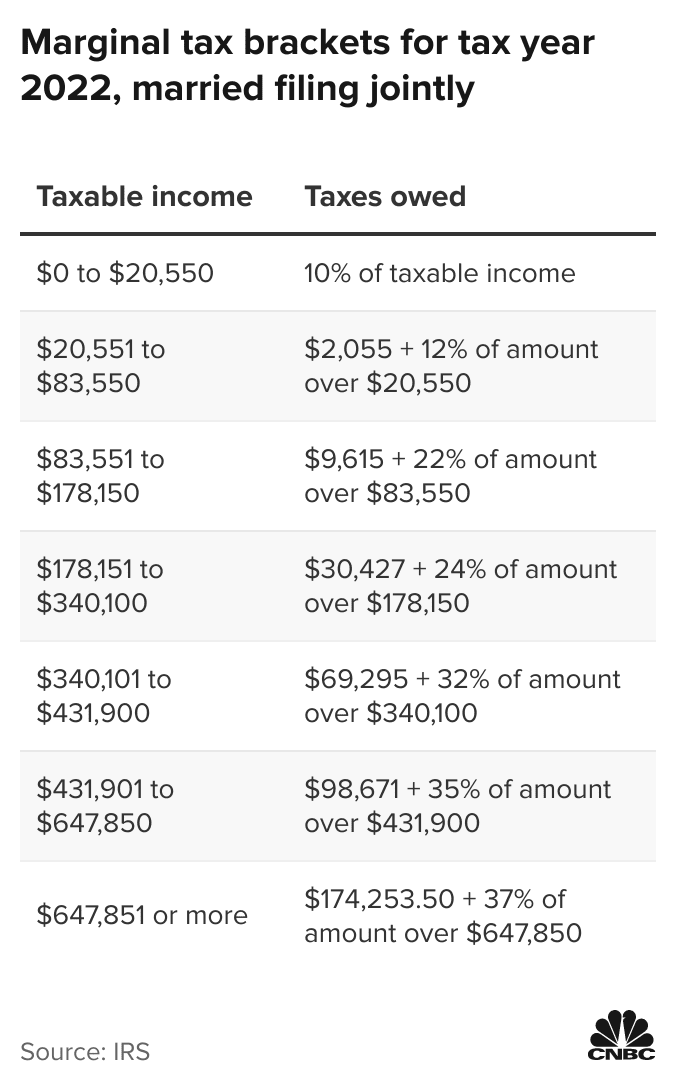

Taxable income between 41775 to 89075. 2022 tax brackets for taxes due in April 2023 announced by the IRS on November 10 2021 for individuals married filing jointly married filing separately and head of household. The IRS changes these tax brackets from year to year to account for inflation and other changes in economy.

Tax brackets can change from year to year. An additional 38 bump applies to filers with higher modified adjusted. These are the rates for.

That puts the two of you in the 24 percent federal income tax bracket. 2022 tax brackets Thanks for visiting the tax center. A married couple can pass on double that.

The top marginal income tax rate. Higher standard deduction The standard deduction will also increase in 2023 rising to 27700 for married couples filing jointly up from 25900 in 2022. Below you will find the 2022 tax rates and income brackets.

The federal tax brackets are broken down into seven 7 taxable income groups based on your federal filing statuses eg. Read on to see whats in store for 2023. 10 tax on her first 11000 of income or 1100 12 tax on income from 11000 to 44735 or 4048 22 tax on the portion of income from 44735 up to 95375 or 11140.

In tax year 2020 for example a single person with taxable income. Youll pay 10 of your gross. Typically the increase is small but this time using the.

Your bracket depends on your taxable income and filing status. Taxable income between 10275 to 41775. The current tax year is from 6 April 2022 to 5 April 2023.

2022 tax brackets for individuals. The tax year 2022 maximum Earned Income Tax Credit amount is 6935 for qualifying taxpayers who have three or more qualifying children up from 6728 for tax year. If you make 11000 or less.

Your tax-free Personal Allowance The standard Personal Allowance is 12570. The maximum tax rate remains at 37. Federal Income Tax Brackets 2022.

To access your tax forms please log in to My accounts General information. Get started by reviewing our list of the best tax software for 2022. This guide is also available in Welsh Cymraeg.

Heres a breakdown of last years income. 2022 tax brackets.

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

March 4 2022 2022 Small Business Tax Brackets Explained Gusto

Bigger Paychecks In 2022 With Expanded Tax Bracket Ranges And A Larger Standard Deduction Aving To Invest

Tax Rates Sunset In 2026 And Why That Matters Barber Financial Group

What Is My Tax Bracket 2022 2023 Federal Tax Brackets Forbes Advisor

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

Inflation Pushes Income Tax Brackets Higher For 2022

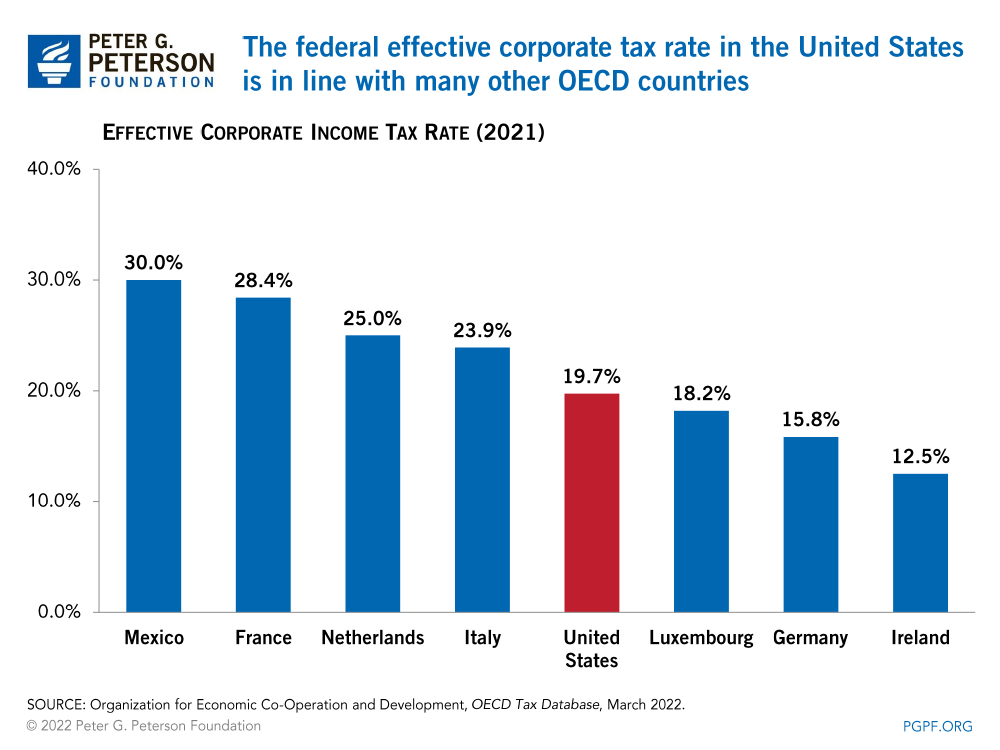

What Is The Difference Between The Statutory And Effective Tax Rate

Irs Tax Brackets 2022 Married People Filing Jointly Affected By Inflation Marca

2021 2022 Federal Income Tax Brackets And Rates

2022 Trucker Per Diem Rates Tax Brackets Per Diem Plus

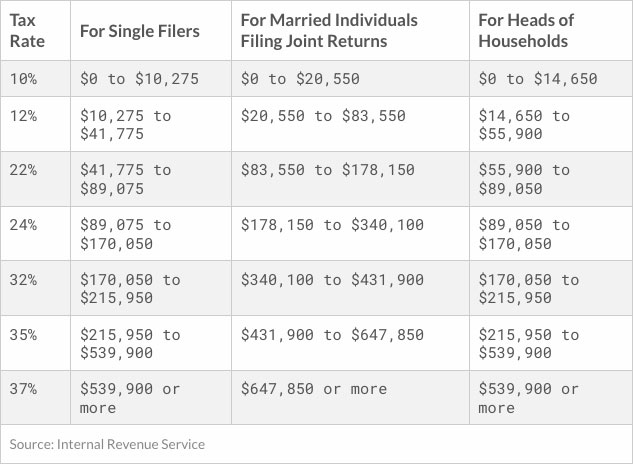

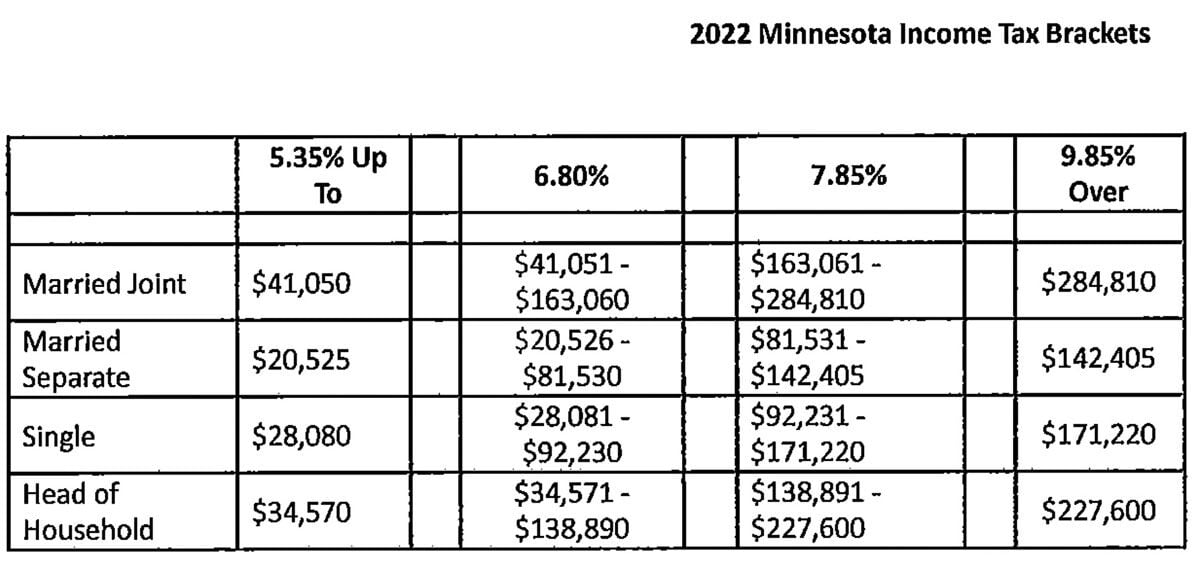

Minnesota Income Tax Brackets Standard Deduction And Dependent Exemption Amounts For 2022 News Walkermn Com

Tax Bracket Calculator What S My Federal Tax Rate 2022

Minnesota Income Tax Brackets Standard Deduction And Dependent Exemption Amounts For 2022 News Walkermn Com

How Tax Brackets Work 2022 Tax Brackets White Coat Investor

Inflation Pushes Income Tax Brackets Higher For 2022

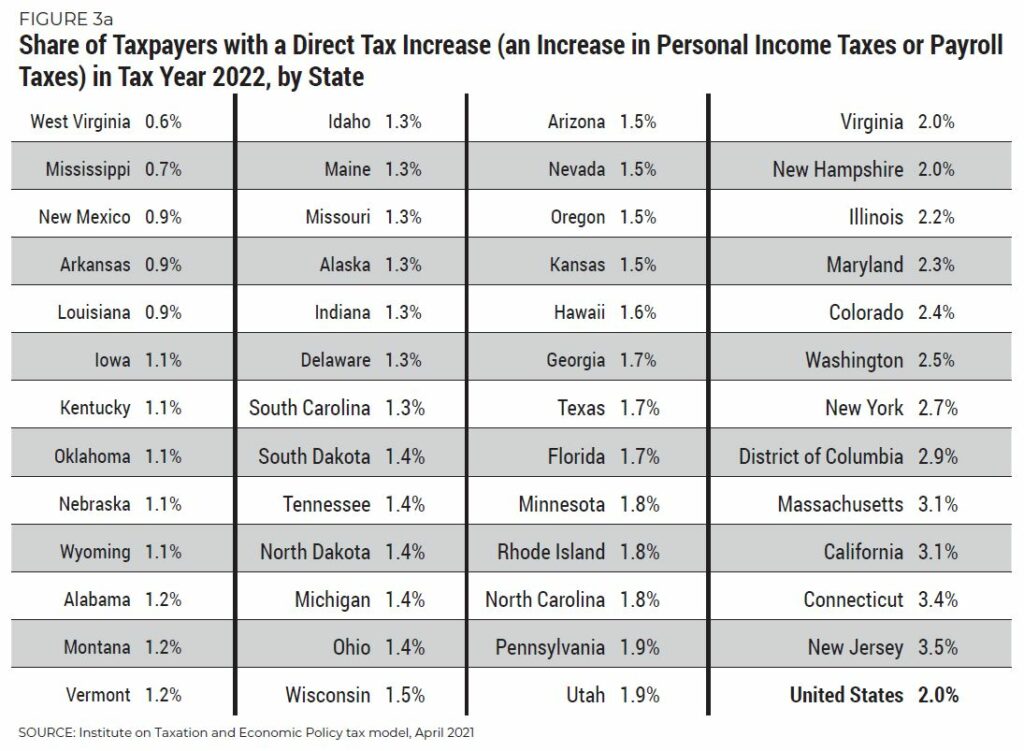

National And State By State Estimates Of President Biden S Campaign Proposals For Revenue Itep